The retailer said on Oct. 25 that it swung to a quarterly loss for the first time in four years. The earnings report, issued after the market closed, immediately sent Amazon shares down 9 percent before recovering.

Amazon lost 60 cents a share in the third quarter, much of it because of a large loss on its investment in the daily deals site Living Social. The consensus estimate was a loss of 8 cents.

It was the first net income loss in 18 quarters. Amazon earned 14 cents a share in the third quarter of 2011.

The company had warned that a loss was coming, saying it expected to lose $50 million to $350 million in the quarter. Its operating loss was $28 million. Profit in the third quarter of 2011 was $79 million.

Revenue was $13.8 billion, a little less than the $13.9 billion that analysts expected. Amazon had predicted that revenue would be $12.9 billion to $14.3 billion. In 2011, third-quarter revenue was $10.9 billion.

Barnes & Noble, struggling to remain relevant in Amazon’s shadow, has been emphatic that it will not carry its competitor’s books. Other large physical and digital stores seem to be uninterested or even opposed to the book. Many independent stores feel betrayed by Mr. Ferriss, whom they had championed. They will do nothing to help him if it involves helping a company they feel is hellbent on their destruction.

Only a few years ago, culture was delivered in discrete doses. “The 4-Hour Chef” would have been in the chain bookstores by the stacks and in independents by the handful. You wanted a book, you went to the bookstore. Simple.

Now the technology overlords — Amazon, Google and Apple — are competing among themselves and with other players to control how the culture is consumed. Amazon’s Kindle Fire was introduced last year to carve out some space from Apple’s iPad; since then, Google and Microsoft have brought out their own tablets.

There is constant jockeying for position. Amazon, for instance, is at odds with Wal-Mart and Target, both of which have stopped selling the Kindle, worried that it is a Trojan horse that will lure their customers away.

Authors who write for these imprints say they are doing well, sometimes extremely well. Their sales are largely digital. They live within the Amazon ecosystem, selling their books from the retailer’s Web site.

For the moment, though, a book that aspires to be a genuine national best seller needs more than that. And that is where the books being acquired by Amazon in New York, which are distributed to the book trade by Houghton Mifflin Harcourt under the New Harvest imprint, are faltering.

Its editors, led by a longtime publishing operative, Laurence Kirshbaum, seem to have backed off, at least for the time being, from buying prominent books.

As publication approaches, Mr. Ferriss has started aggressively promoting “The 4-Hour Chef” on his blog, announcing a weight-loss contest. The book might need all of his considerable promotional talents. It has not yet generated instant heat even on Amazon.

Forced to Collect Taxes, Amazon’s in a Building Frenzy

Since the company’s founding, Jeffrey P. Bezos, Amazon’s chief executive, has held on tightly to a 1992 Supreme Court decision that said mail-order merchants did not have to collect tax in states where they did not have physical operations. (Consumers were supposed to pay a use tax directly to the state, but few did.)

But states began aggressively asserting that Amazon should collect taxes in 2008, when New York passed a law compelling the company to do so. Amazon is

challenging the law in court, but is beginning to collect taxes in California, Texas, Pennsylvania and other states

As the company is about to lose perhaps its biggest competitive edge, it has embarked on

a multibillion-dollar construction frenzy, building distribution centers across the country. New warehouses are being built in Patterson, Calif., and on the outskirts of Los Angeles. Others are under way in Indiana, New Jersey, South Carolina, Tennessee and Virginia.

Amazon is hoping that the warehouses will allow it to provide better service, giving it the ability to up-end the retailing industry in an entirely new way by cutting as much as a day off its two-day shipping times.

Amazon began collecting taxes in California on Sept. 15, 2012. It started collecting taxes in Texas over the summer, and in Pennsylvania on Sept. 1. New Jersey’s turn will come

in the summer of 2013, and several other states over the next two years. The company seems to be surrendering on the tax issue mostly in those states where it sees strategic value in new warehouses. Company officials say they hoped to see a national sales tax law in place that will supersede state laws.

Background

Amazon.com, the world’s largest online retailer and one of the nation’s biggest book sellers, is one of the most iconic companies of the Internet era. It was founded in Seattle in 1994 by Jeffrey P. Bezos.

Mr. Bezos, who is known as Jeff,

was a 30-year-old hedge fund analyst with a degree in computer science and electrical engineering from Princeton when he came up with the idea for an online bookseller. He called it

Amazon because he thought it would convey the vast breadth of books he intended to sell.

And books were just the beginning. The company soon expanded to other categories: CDs, movies, toys, furniture, clothing and groceries.

Amazon went public on May 15, 1997, but did not make a profit until 2002. Its stock was hammered during the dot-com bust but, by 2007, was on the upswing, aided by the migration of consumers to the Web, growing trust in e-commerce and Amazon’s overall reputation for good prices, broad selection and convenience.

From Print to Digital: The Kindle

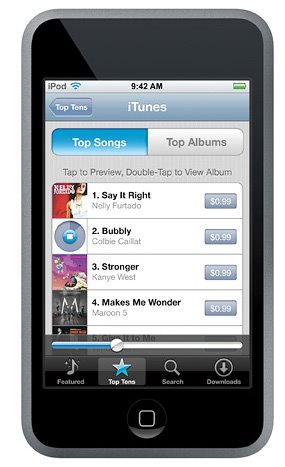

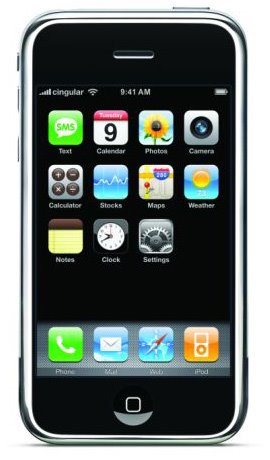

In November 2007, the company made the leap from selling others’ products to selling its own, when it introduced the Kindle, an electronic book reader with the capability of downloading books wirelessly. A few other companies, notably Sony, had been selling electronic book readers, but Amazon’s approach seemed to create a completely new experience, offering users the chance to buy virtually any book at any time anywhere.

By May 2009, the Kindle had become the company’s biggest selling product. Amazon built up a 90 percent share of the American e-book market, in part because it sold most new releases and best sellers at a heavily discounted standard price of $9.99. Many Kindle owners said the low price motivated them to buy more e-books, but publishers feared that the price would eventually erode their profits.

In July 2010, Amazon announced that during the previous three months, sales of books for the Kindle had for the first time outnumbered sales of hardcover books. By May 2011, Kindle

was outselling hardcovers and paperbacks. For Amazon, it was proof that it had successfully made the transition from a print business to a digital one, a change that has challenged most companies that sell media.

The Kindle’s success brought a string of competitors into the market, most notably the iPad, Apple’s tablet computer. Amazon responded to the Apple threat by waging a publisher-by-publisher battle, trying to keep as many books as possible out of Apple’s hands, while preserving as much flexibility as possible to set its own prices.

The Kindle Fire was the company’s long-awaited response. The device had a 7-inch touchscreen, weighed 14.6 ounces and was outfitted with a dual-core processor. But the most important feature was the price. At $199, the Fire was less than half the price of the Apple

iPad, which started at $499. It was the first tablet from a major company to seriously undercut the iPad in price.

However, the Kindle Fire was

less than a blazing success with many of its early users. A few of their many complaints: there was no external volume control. The off switch was easy to hit by accident. Web pages took a long time to load. There was no privacy on the device: a spouse or child who picked it up would instantly know everything you had been doing. The touch screen was frequently hesitant and sometimes downright balky.

The Kindle Fire relies on Android, Google’s mobile operating system, and uses a new browser, Amazon Silk. Amazon is trying to make mobile Web browsing faster and easier by using cloud computing to do some of the heavy lifting that used to be handled only by the browser in your device, which can’t compete in power with a huge number of computers in a warehouse somewhere.

Updating the Kindle Fire

In September 2012, Amazon announced updates to the Kindle line, including the Kindle Fire HD, a tablet computer that comes in two sizes, one that is nearly as large as the iPad and that undercuts its price by $200.

The company also announced the Kindle Paperwhite, a version of the black-and-white Kindle that is thinner and faster than its predecessor. It also has a new kind of screen, lighted from the bottom, that has a higher contrast and is easier to read, including in the dark.

The Kindle Fire HD challenges the iPad on several fronts. The larger version of the device has an 8.9-inch display, compared with the iPad’s 9.7 inches. The Amazon device also has a front-facing camera with Skype integration, which directly competes with the front-facing camera on the iPad and Apple’s FaceTime video conferencing features. Like the iPad, the latest Kindle Fire offers 16 gigabytes of storage.

The larger version of the Kindle Fire HD costs $300; the baseline iPad costs $500. Amazon is also offering a $500 version of the Kindle Fire HD with cellular data connectivity, which is cheaper than Apple’s least expensive iPad with cellular connectivity, which costs $630.

Amazon has worked with a number of partners — including Facebook, Microsoft and game developers — to create applications designed specifically for the Kindle Fire HD. The apps are available for purchase through Amazon, along with other content like video, music and books.

Battle Over Online Taxes

In June 2011, the company set out on an ambitious and far-reaching agenda: to rewrite tax policy for the Internet era.

Since Amazon’s founding in 1994, it had avoided collecting sales tax from customers in California. Not collecting taxes gave Amazon a price advantage over its rivals, most of whom collect sales tax in the state. The law said that an online retailer needed to collect taxes on purchases if it had a physical presence, or a nexus, in a particular state. Any retailer with an office or warehouse qualified. Amazon had no such facility in California and argued that it should not be required to collect sales tax.

So California changed the law. In June 2011, Gov.

Jerry Brown of California signed legislation requiring online retailers to collect sales tax on purchases. But Amazon aggressively resisted the new legislation with all the resources of a company whose stock market valuation is nearly $100 billion. In an unusual move, Amazon spent $5 million to gather a half-million signatures to take the matter to voters in a referendum next June. The company also made a counterproposal: if California dropped the tax issue for a few years, the retailer said it will build two warehouses in the state and hire 7,000 workers. In a state with 12 percent unemployment, that was an attractive offer.

Opposing Amazon were traditional retailers as big as Wal-Mart and Target and as small as the neighborhood bookstore — the few that are left.

Amazon’s efforts paid off. In September 2011, California lawmakers overwhelmingly

approved a compromise bill giving Amazon a one-year reprieve from having to collect a sales tax from its customers in the state. Under the new measure, Amazon agreed to start collecting the tax on Sept. 15, 2012.

Lawmakers had hoped to collect $200 million in taxes from Amazon and other online retailers for the current state budget. That money will now have to be found elsewhere.

Beyond Products

In addition to selling physical media like CDs, DVDs and books, the company sells digital copies of these products as well. Amazon Unbox, which lets customers download movies and TV shows to their computers and certain TiVo boxes, opened in the fall of 2006. In September 2007, the company rolled out its Amazon MP3 store, a rival to Apple’s iTunes that makes downloadable music available without the cumbersome anti-copying software called D.R.M., or digital rights management. The service now has the participation of all the major music labels.

Amazon has also positioned itself as a technology company through a fledgling effort called Amazon Web services, in which it rents out parts of its back-end infrastructure to other companies. Among the tools it offers was Amazon S3, which let companies store their data on Amazon’s computers, and Amazon EC2, which let customers use Amazon’s computers for large-scale computational tasks.

In the Publishing Game, Too

Amazon has taught readers that they do not need bookstores. Now it is encouraging writers to cast aside their publishers.

In fall 2011, Amazon

began publishing books in an array of genres, in both physical and e-book form. It is a striking acceleration of the retailer’s fledging publishing program that places Amazon squarely in competition with the New York houses that are also its most prominent suppliers.

It has set up a flagship line

run by a publishing veteran, Laurence Kirshbaum, to bring out brand-name fiction and nonfiction. In August 2011, it signed its first deal with the self-help author

Tim Ferriss. In mid-October it announced a memoir by the actress and director Penny Marshall, for which it paid $800,000, a person with direct knowledge of the deal said.

Amazon had been publishing books for several years, but its efforts went up several notches in visibility when it hired Mr. Kirshbaum in May 2011 as head of Amazon Publishing. The company’s foray into book publishing is not welcome news for many in the industry, who are nervous about the intentions of the company, with its deep pockets and unparalleled distribution system into tens of millions of living rooms and onto electronic devices.

Publishers say Amazon is aggressively wooing some of their top authors. And the company is gnawing away at the services that publishers, critics and agents used to provide.

Amazon has started giving all authors, whether it publishes them or not, direct access to highly coveted

Nielsen BookScan sales data, which records how many physical books they are selling in individual markets. It is introducing the sort of one-on-one communication between authors and their fans that used to happen only on book tours.

Government Sues Publishers and Amazon Wins

In mid-April 2012, the Justice Department

filed an antitrust lawsuit against Apple and five of the largest book publishers, charging that the companies colluded to raise the price of e-books. The government’s decision has put Amazon in a powerful position: the nation’s largest bookseller may now get to decide how much an e-book will cost, and the book world is quaking over the potential consequences.

The government said the five publishers colluded with Apple in secret to develop a new policy that let them set their own retail prices, and then sought to hide their discussions. After that deal was in place in 2010, the government said, prices jumped everywhere because under the agreement, no bookseller could undercut Apple.

Amazon, which already controls about 60 percent of the e-book market, can take a loss on every book it sells to gain market share for its Kindle devices. When it has enough competitive advantage, it can dictate its own terms, something publishers say is beginning to happen.

As soon as the Justice Department announced that it was suing the publishers on price-fixing charges, Amazon announced plans to push down prices on e-books. The price of some major titles could fall to $9.99 or less from $14.99, saving voracious readers a bundle.

But publishers and booksellers argue that any victory for consumers will be short-lived, and that the ultimate effect of the antitrust suit will be to exchange a perceived monopoly for a real one. Amazon, already the dominant force in the industry, will hold all the cards. For more on the case, click

here.

Amazon Takes on High Fashion

Having wounded the publishing industry, slashed pricing in electronics and made the toy industry quiver, Amazon is taking on the high-end clothing business in its typical way: go big and spare no expense.

Amazon has sold clothing for years. But recently it has focused on signing on hundreds of contemporary and high-end brands, including Michael Kors, Vivienne Westwood, Catherine Malandrino, Jack Spade and Tracy Reese, and it continues to prowl for more.

While

its MyHabit site, started in 2011, uses a flash-sale model to compete with Gilt Groupe, Jeff Bezos, Amazon’s chief executive, says the company’s new effort is not about selling clothes at deep discounts but at prices that ensure that “the designer brands are happy.” But there are many disbelievers, given Amazon’s history in other industries.

Even so, for some brands, the company’s size alone makes an overture from Amazon difficult to reject.

Amazon can afford to do things that some competitors cannot, like hire a

bevy of stylists for the Web site models or investigate replacing the plain brown shipping box with a fancier package for clothes.

Until now, fashion has been one of the few categories that Amazon has tried to dominate without success. In addition to its own site, Amazon bought the shoe site Zappos.com for more than $1 billion in 2009, started the shoe site

Endless.com and MyHabit, and bought the boutique Shopbop in 2006.

But many brands stayed away because they said Amazon’s site often looked too commoditized. Amazon hopes to fix that problem by going luxe.

In the retail clothing world, fears are growing that few will be able to compete with a stepped-up Amazon.

Reshaping Computing Through Cloud

Within a few years, Amazon’s creative destruction of both traditional book publishing and retailing may be footnotes to the company’s larger and more secretive goal: giving anyone on the planet access to an

almost unimaginable amount of computing power through its cloud services.

Cloud computing has been around for years, but it is now powering all kinds of new businesses around the globe, quickly and with less capital. Today, thousands of companies rent data storage and computer server time from Amazon, through its

Amazon Web Services division, for what they say is a fraction of the cost of owning and running their own computers.

Instagram, a 12-person photo-sharing company that was sold to

Facebook for an estimated $1 billion just 19 months after it opened, skipped the expenses and bother of setting up its own computer servers.

EdX, a global online education program from the Massachusetts Institute of Technology and Harvard, had over 120,000 students taking a single class together on A.W.S. Over 185 United States government agencies run some part of their services on A.W.S. Millions of people in Africa shop for cars online, using cheap smartphones connected to A.W.S. servers located in California and Ireland.

Andrew R. Jassy, the head of A.W.S., started the service in 2006 with about three dozen employees. Amazon won’t say how many people now work at A.W.S., but the company’s Web site currently lists over 600 job openings.

Amazon’s efforts are just the start of a global competition among computing giants. In June, Google fully introduced a service similar to A.W.S. Microsoft is also in the business with its offering,

Windows Azure.

If only for competitive reasons, Amazon does not say much about A.W.S. However, it is estimated to bring in about $1 billion to Amazon. Its three giant computer regional centers in the United States, in Virginia, Oregon and California, each consist of multiple buildings with thousands of servers.

There are others in Japan, Ireland, Singapore and Brazil. And the pace of its expansion has quickened. It opened four of those regions in 2011 and is believed to be building a similar number now.

Jeff Bezos, the chief executive of Amazon, is interested in setting up cloud-computing installations for other governments.

All that data running through Amazon’s cloud also has value. People leave bits of data about themselves that others then analyze. At any given time on A.W.S., there are about one million uses of a powerful database,

called Elastic MapReduce, that is used to make predictions. Some suggest a new movie or video game to play, while others log behavior for advertising, credit history or suggestions about whom to date. (Companies have to permit their data to be analyzed, and Amazon says it applies the same security standards it uses on its retail site.)

Wal-Mart Deletes the Kindle From Stores

Wal-Mart did not specify why it was discontinuing its Kindle sales, but analysts said it was not hard to decipher, given that the retailer will still sell similar devices from companies like Apple, Google, Barnes & Noble and Samsung.

Physical retailers

have been worried about customers who browse in stores and then buy from online competitors instead. Displaying the new Kindles encourages that behavior, analysts said.

While earlier black-and-white Kindles were good only for reading digital books, the Kindle Fire can be used for e-books, movies, games, and potentially anything Amazon sells, thanks to a built-in Web browser.

Moreover, the Kindle line, and most tablets, are only marginally profitable for retailers.

2012 Earnings: Third Quarter

2012 Earnings: Third Quarter